Opening Opportunities: The Complete Guide to EB5 Visa for UK Citizens

The EB5 visa program offers a path for UK citizens seeking permanent residency in the United States with financial investment. Recognizing the qualification standards and financial investment needs is important for possible applicants. This guide supplies a considerable review, consisting of understandings on direct financial investments versus local centers. As investors navigate this complicated process, they need to also take into consideration the work production needs and the advantages that come with the EB5 visa. What aspects will ultimately influence their choice?

Recognizing the EB5 Visa Program

While many migration alternatives exist for individuals looking for to move to the USA, the EB5 Visa Program attracts attention as a special pathway for capitalists. Designed to promote the united state economy, this program allows foreign nationals to acquire long-term residency by spending a minimum of $1 million, or $500,000 in targeted work areas. Investors have to create or preserve at the very least ten permanent jobs for united state employees through their investment in a brand-new commercial business. The EB5 Visa not just offers a route to U.S. citizenship but likewise supplies investors the possibility to engage in numerous business endeavors. This program charms especially to those wanting to expand their properties while contributing to the financial advancement of the United States.

Qualification Requirements for UK Citizens

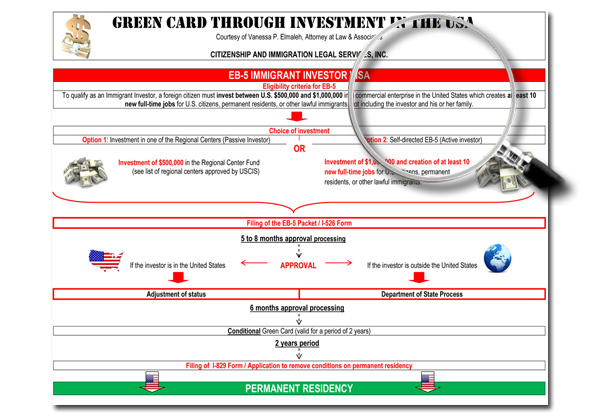

The Investment Process Explained

Guiding the financial investment procedure for the EB5 Visa entails numerous vital steps that have to be carefully followed to guarantee conformity with U.S. immigration legislations. First, capitalists have to select in between direct financial investment or engagement in a designated local facility. Next off, they need to prepare the essential documents, consisting of evidence of funds' validity and a thorough organization strategy that shows how the investment will develop the required tasks. After choosing a proper financial investment possibility, the financier has to transfer the capital, which is commonly a minimum of $1 million, or $500,000 in targeted employment locations (Investor Visa). Submitting Type I-526 with the U.S. Citizenship and Migration Solutions is important to initiate the application procedure and secure the capacity for irreversible residency.

Regional Centers vs. Direct Investment

When considering the EB5 visa, UK citizens encounter a selection in between investing with local facilities or selecting straight investment. Each option features distinct financial investment frameworks, varying job creation needs, and varying degrees of threat assessment. Comprehending these differences is crucial for making an educated choice that lines up with individual investment goals.

Financial Investment Structure Differences

While both Regional Centers and Direct Financial investment represent pathways for obtaining an EB5 visa, they differ considerably in framework and requirements. Regional Centers are organizations marked by the United States Citizenship and Migration Solutions (USCIS) that pool investments from several investors into bigger tasks. This structure permits a much more varied risk and commonly entails much less straight administration from the financier. On The Other Hand, Direct Investment requires a capitalist to position their funds into a details organization and take an active role in its monitoring. This direct strategy commonly requires more hands-on involvement and a complete understanding of business landscape. Each choice presents distinct difficulties and benefits, influencing the capitalist's decision based upon personal preferences and financial investment objectives.

Job Development Demands

Job creation demands are an essential element of the EB5 visa process, differing significantly in between Regional Centers and Direct Investment alternatives. Regional Centers concentrate on job development indirectly, permitting investors to count jobs developed via financial task promoted by their financial investments. A minimum of ten tasks should be created or maintained per capitalist, typically attained via larger, pooled financial investments in tasks like real estate developments. Alternatively, Direct Financial investment mandates that financiers directly develop at the very least 10 permanent jobs within their very own services. This approach may call for more active monitoring and oversight by the financier. Recognizing these differences is vital for possible EB5 applicants, as the chosen path substantially influences their capability to meet the program's job creation needs.

Risk Assessment Considerations

Just how do danger aspects vary in between Regional Centers and Direct Investment choices in the EB5 visa program? Regional Centers commonly provide a varied financial investment method, merging funds from multiple capitalists into bigger projects, which can alleviate private danger. Nevertheless, the success of these centers counts on their administration and job selection, presenting potential pitfalls if badly managed. Conversely, Direct Financial investment enables capitalists to preserve better control over their funds by spending directly in a company. While this choice might give a more clear understanding of investment procedures, it also carries greater threats as a result of the private business's efficiency and market volatility. Ultimately, investors need to weigh the advantages of control against the inherent threats of direct involvement versus the collective protection of Regional Centers.

Job Production Needs

A vital element of the EB5 visa program involves meeting specific task production demands, which are important for making sure the successful assimilation of foreign investors right into the U.S. economy. To qualify, an EB5 investor must develop or maintain at the very least ten permanent tasks for U.S. employees within two years of their financial investment. find out here These work have to be straight, indicating they are produced straight by the company in which the capitalist has actually spent. Conversely, if buying a targeted work location (TEA), the financier might also be eligible with indirect work creation, which is determined based on economic effect. Meeting these task creation demands not just benefits the capitalist yet additionally contributes positively to local areas and the total U.S. labor force.

Advantages of the EB5 Visa

The EB5 visa program supplies various benefits for capitalists looking for a path to long-term residency in the United States. One of the key advantages is the possibility to get visa for the capitalist, their spouse, and single kids under 21. This visa offers a distinct path to live, function, and research study in the united state Furthermore, the EB5 program allows financiers to expand their possessions while adding to the U.S. economic climate with task production. Unlike many other visa categories, the EB5 visa does not require a particular business background or managerial experience, making it easily accessible to a larger target market. Furthermore, it uses a path to citizenship after satisfying residency needs, which boosts lasting protection and stability for family members

Common Obstacles and Factors To Consider

While the EB5 visa program presents substantial chances, it additionally entails different difficulties and factors to consider that prospective financiers have to browse. One main issue is the significant economic commitment, calling for a minimum financial investment of $900,000 in targeted work locations. Furthermore, financiers should be gotten ready for an extensive application procedure, which can take numerous months, if not years. Regulatory adjustments and the progressing landscape of immigration legislations pose more unpredictabilities. Capitalists should additionally consider the risks connected with the selected financial investment project, consisting of prospective company failures. Recognizing the effects of U.S. residency demands and the impact on family members is vital. Subsequently, comprehensive research study and specialist support continue to be vital for a successful EB5 visa journey.

Often Asked Concerns

For how long Does the EB5 Visa Process Typically Take?

The EB5 visa procedure generally takes between 12 to 24 months - EB5 Visa. Variables affecting the timeline consist of application efficiency, USCIS handling times, and potential hold-ups from regional centers or additional paperwork requests

Can I Include My Household in My EB5 Visa?

Yes, a candidate can include their instant relative in the EB5 visa (British Investor). This normally encompasses a spouse and unmarried children under the age of 21, permitting family members unity during the migration procedure

What Occurs if the Investment Fails?

If the investment fails, the person may shed their funding and potentially deal with obstacles in obtaining permanent residency. It is important to conduct extensive due diligence and take into consideration the risks connected with EB5 investments.

Exist Any Type Of Age Restrictions for EB5 Investors?

There are no certain age constraints for EB5 investors. Both minors and grownups can participate, however minors need a guardian to handle their financial investment. Correct legal assistance is suggested to navigate the intricacies involved.

Can I Operate In the united state. While My Application Is Pending?

While an EB-5 is pending, people can not function in the U - British Investor.S. unless they hold a valid copyright. Authorization of the EB-5 gives qualification for employment without extra work permission

Investors should create or maintain at least 10 permanent work for United state employees via their investment in a brand-new industrial venture. Regional Centers focus on work production indirectly, permitting financiers to count tasks produced through economic task promoted by their investments. A minimum of ten jobs have to be produced or maintained per investor, frequently accomplished via bigger, pooled investments in tasks like real estate growths. Alternatively, Direct Financial investment mandates that investors straight create at least ten full time work within their very own services. To qualify, an EB5 financier must develop or protect at least 10 full time work for United state employees within 2 years of their financial investment